I recently asked my Facebook fans what price they would retail an item for if they purchased it for $50.

I had answers ranging from $200 to $83.50 with all kinds of reasoning, like someone trying to be funny: "It depends on if the moon is full or not."

But making more money isn't a laughing matter. That's why I recently held a webinar with Jennifer Abraham Rust, founder and CEO of Creative Profit Planning, who works to develop roadmaps to profitability for independent retail stores, guiding them down the path to resolving their financial challenges and putting more money in their pockets.

Jennifer shared the exact formula for calculating the profit needed to drive retailers’ bottom lines.

Here are some crucial takeaways from that webinar for retailers aiming to navigate financial challenges and secure their business's future:

How to Understand your Financials

Jennifer highlighted the alarming trend of retailers not compensating appropriately due to a lack of comprehensive financial awareness. Key components like initial markups, operating expenses, and desired net profit percentages are vital in thoroughly understanding your store’s financials and crafting a profitable business model.

The Art of Pricing for Profit

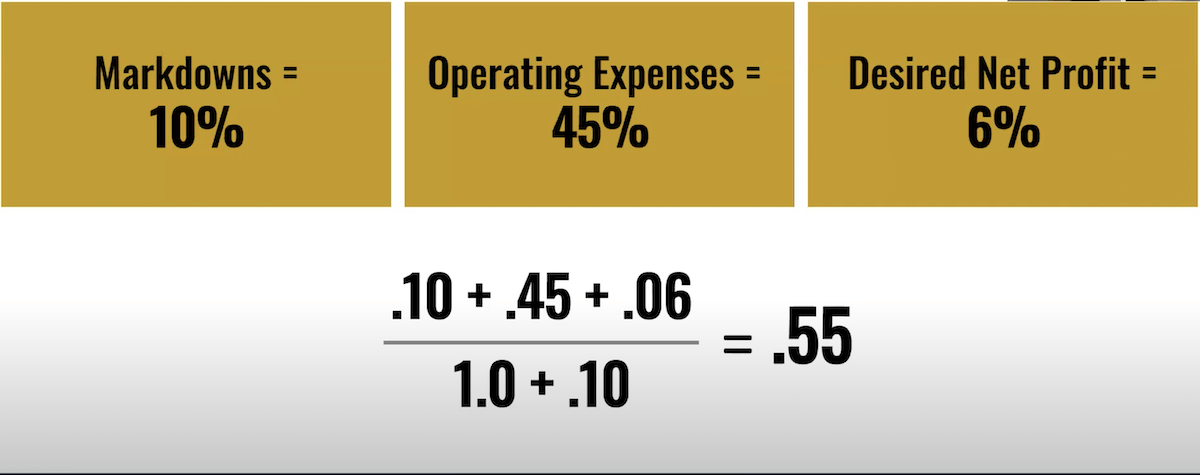

Jennifer demystified common pricing strategies and stressed the significance of setting prices that cover costs and ensure a healthy profit margin. The formula for calculating the necessary initial markup is based on correlating operating expenses, desired net profit, and the impact of markdowns on profitability.

Not only is there a why, but there is also an absolute definitive rule: "You must have an initial markup of at least this much in your store" to make your store at least break even.

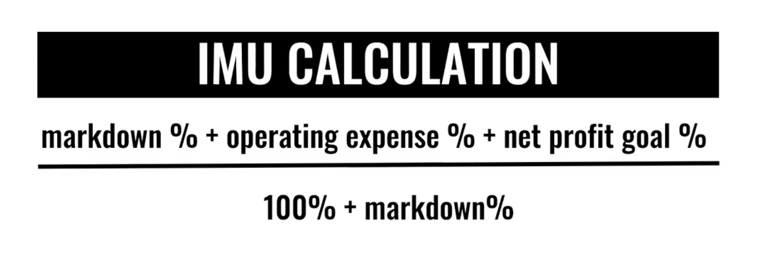

The Initial Markup (IMU) Calculation Jennifer utilizes in her work with retailers is: Markdown % + Operating Expense as a Percent of Sales + Net Profit Goal Divided By 100% + Markdown %. Where to find that data?

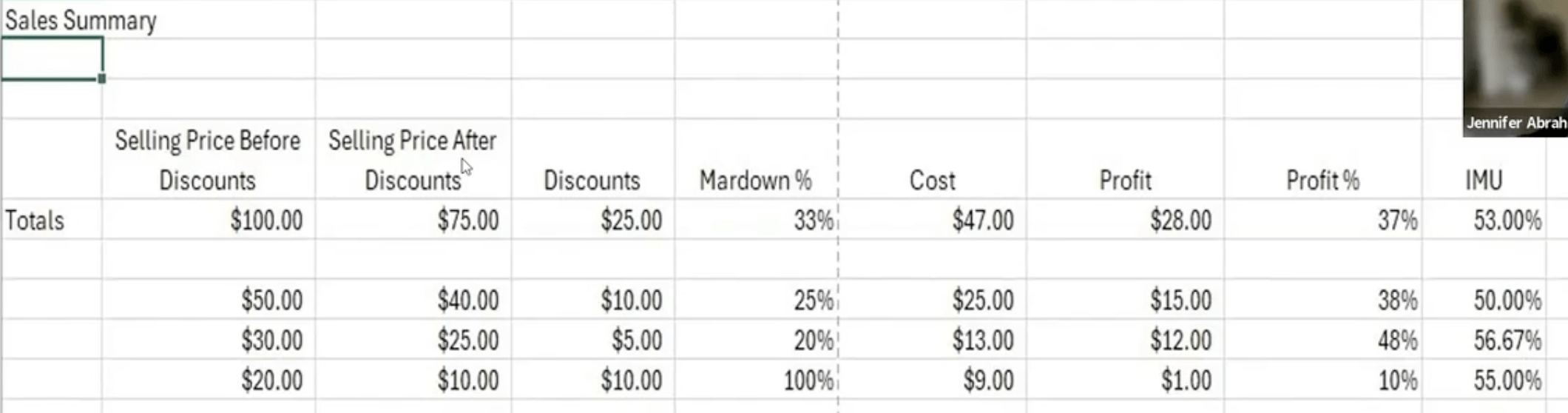

Locate a sales summary in your POS system that shows your selling price before discounts, your selling price after discounts, your discount, and your markdown percentage. In familiarizing yourself with the summary, you’ll discover it’s a balancing act.

If your overall markup is not the % you expect, then something here has to give. Lower your operating expenses, give up some of your net profit, or lower some markdowns. The formula has to work if you want that desired net profit.

How to Figure Inventory Management and Turns

Substantial time was devoted to discussing inventory turnover rates and their influence on cash flow and profitability. High inventory turnover indicates efficient management, translating to increased cash flow and less money tied up in unsold stock. The webinar outlined strategies for achieving optimal inventory levels and turns, encouraging retailers to evaluate and adjust their inventory buying and selling approach.

How to Account for Discounting and Loyalty Programs

Discount strategies and loyalty programs were also addressed, focusing on their implications for retail margins. Attendees were urged to scrutinize the true cost of discounts and loyalty rewards, ensuring that these initiatives contribute to customer retention and sales without eroding profitability.

How much should we price that $50 item?

What should the price be if we were taking that fifty-dollar item I mentioned at the start? We would divide it by the inverse if we wanted a 55 percent IMU. So, we would divide it by 45 percent and get $111.

Conclusion

The Profit Webinar laid bare the complexities of retail management and gave us a pathway to success. By focusing on financial literacy, savvy pricing, inventory discipline, mindful discounting, and leveraging technology, retailers can navigate the challenges of today's market. I encourage you to watch the full video and take lots of notes.

Retail success is no laughing matter. You only get the results you need to live the life you want from strategic planning, financial acumen, and the relentless pursuit of excellence. Whether you're a budding entrepreneur or a seasoned retailer, these pricing lessons underscore the importance of investing in looking at your data to drive profitability and growth.