Analyzing the Top 16 Retail Trends at NRF 2023

Subscribe to our newsletter

The 2023 National Retail Federation Big Show was a glimpse into the future of retail, showcasing the top trends transforming the industry. From authenticity and mood shifts to RFIds and POS systems leapfrogging over the competition, holograms, drones, altered reality, and web 3 retail media networks; the show demonstrated how retailers are optimizing their operations for success. Here are sixteen Retail Trends and developments you should be aware of.

Because I was speaking out of the country during the show this year, I had to rely on my retail expert friends Niki Baird, Ricardo Belmar, James Tenser, and Nicole Leinbach to share their impressions of the show. They did such a great job that international travel may be on the agenda next year as well.😊

1. Authenticity

Neal Hubman, global head of client solutions at Reddit, thought authenticity was a key theme; he advised the audience that younger generations are open to brands entering new and more social spaces if it’s done in the right way. “Are younger generations losing trust in brands? It depends,” Hubman said. “The majority of them said they would welcome brands into this space or their communities as long as there’s a value add there. The biggest thing is to create trust; it needs to be in some authentic way.”

Nikki Baird, VP of Strategy for Aptos

Nikki Baird, VP of Strategy for Aptos

2. Mood Shift

Nikki: "I suspect that retailers did better over the holidays than they thought they would. While everyone was happy to see each other and be in person, for some of us, for the first time in 3 years, that alone does not explain the good mood retailers were in, nor the interest they showed in adding to their technology capabilities. I saw the overall numbers of December sales up 6% YoY, which would not offset inflation, and I know it was a mixed bag across categories. Still, I also have not seen the aggressive markdowns that I expected to roll out in January. So, I could easily be proven wrong. Still, I think retailers will say their inventory position into January is better than they expected, and their margins over the holiday were better than they expected."

3. RFID

Nikki: "As far as technology, I heard a lot more overall interest in RFID, but still with a healthy dose of skepticism from those who have not yet tried it. Item-level in-store inventory tracking is more of a possibility now for retailers & brands than I’ve ever seen it. Omnichannel and being able to promise inventory with confidence are the main drivers."

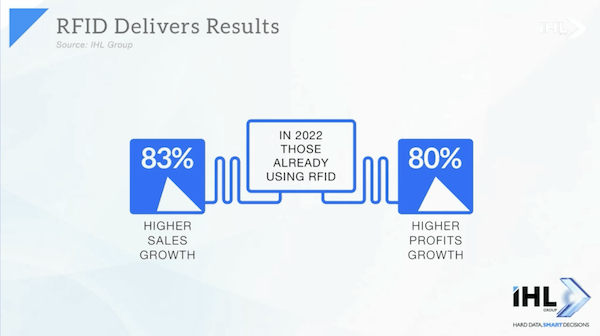

Bob: Winners are adopting radio frequency ID tags and reaping the benefits, as Greg Buzek with IHL shared in a recent webinar, click to read their in-depth report on even more retail trends from NRF.

4. POS

Nikki: "A POS refresh is definitely coming. Retailers want to eliminate the store server once and for all. They need to refresh hardware that may be as many as three years past its expiration date, and they want more mobility in the hands of store associates. They want simplification – one device to serve many purposes and streamlined solutions that make it easy for a store associate to move back and forth from ringing sales to picking online orders for pickup, to processing a return, to enrolling a customer into the loyalty program."

5. Leap Frogging over the Competition

Nikki: "Probably the most interesting thing we heard from retailers is that they don’t just want to catch up – they want to leapfrog (whether that is realistic or not is a separate conversation). Even retailers who are on 15-year-old tech are not just trying to catch up. They want to know what’s next; they want to be better positioned to meet it, and they value flexibility and continuous innovation at least as much as they value low prices. For companies that have milked their solutions past even the life of some of the underlying tech components, that is very refreshing."

6. Holograms

Nikki: "There was a lot more 3D holographic stuff than I expected. It’s all still “interesting” but not “valuable”. Lots of chatbots and live stream platforms in the startup zone." Read more of Nikki's thoughts here.

7. Drones

Bob: On the heels of Walmart raising their minimum wage to $14, Susan Reda, the VP of Education at NRF, thought one of the sessions that she found eye-opening was drones. "Walmart is leading the way, and when Walmart dives in, it's always worth paying close attention."

8. Optimizing Operations

Ricardo: "Most of those challenges were not about exploiting the metaverse or other pie-in-the-sky technologies - but more about how do I optimize my operations, help my store teams become more productive and efficient while making their work environment better so I retain them, and how do I manage to grow profitably in these current economic times. There was talk of inflation, but that didn’t ruin the mood. Retailers were on a mission to learn and discover what tech can help them this year."

9. Altered Reality and Machine Learning

Ricardo: "Computer vision, AI, and other big technologies were everywhere. The most eye-catching demos were AR tech that would allow shoppers to try on clothing without trying them on in a fitting room. And the metaverse? Well, it was more down to earth. Digital Twins emerged as the top use case that has relevance, both to manufacturer brands and retailers. CPGs are already making use of these to help optimize their production lines and to lower the cost of developing new products, but now retailers are looking at this use case to model store layouts, assortments, merchandising, and more without incurring the cost of physically experimenting in a real store (and tying up precious frontline store teams with tedious work away from customers)."

10. Web3

Ricardo: "Web3 was still around, too, with more focus on how it, and blockchain, can help in the supply chain to authenticate merchandise and how it can enhance loyalty programs. This last one caught my attention because I’m hearing retailers see an opportunity this year to focus on their most loyal customers and grow their share of wallet versus spending more on new customer acquisition. We will see how that plays out in 2023."

11. Retail Media Networks

Ricardo: "Stores are back and back strong, and you could hear that everywhere at NRF. In-store is where it’s at in 2023, and the best example of this I can give is retail media networks."

(Photo from Ben Miller with Shoptalk)

(Photo from Ben Miller with Shoptalk)

What are retail media networks?

While there were not a lot of sessions on Retail Media Networks, the clear evolution of these networks is how the media offering will be integrated in-store so retailers can offer much more insights to brands on shoppers where 85% of sales still happen. The winners in retail media will be the ones that maximize the opportunity in their stores and delivery on reporting to brands so they can see the true ROAS for each media network."

Hear Ricardo’s latest podcast drop with 2023 predictions here.

James Tenser, President of VSN Strategies

James Tenser, President of VSN Strategies

James: "NRF is too big for one analyst to take in, no matter how determined! This year’s Big Show hit a lot of the right notes, and there was an upbeat atmosphere that continued from the Sunday morning general sessions through the close of the exhibit floor Tuesday evening."

12. Practical Measures

James: "Certainly, inflation, labor, supply chain, and the economy had to be the most pervasive mega-theme. Nearly every speaker I heard made some reference to this set of challenges, but there was no sense of doom. Instead, there was talk about practical measures. Leaders spoke of operating cost control, streamlining the supply chain, right-sizing inventories, making jobs better, and downsizing store footprints."

13. Rightsizing and Growing Physical Stores

James: "Macy’s Chairman and CEO Jeff Genette described an ongoing transformation of many of its physical stores. They are closing some legacy mall locations, now vastly oversized, and opening much smaller locations – typically 40,000 square feet – in strip-center locations nearby. The best “talent” are being brought over to run those new stores. Additionally, in 35 markets so far, all or part of large stores have been converted into regional distribution centers that put inventories closer to the physical and digital points of sale."

14. Eliminating Mind-Numbing Tasks for the Frontline

James: "The tight labor market was also invoked repeatedly. Smart technology that vastly reduces 'junk' work, like repetitive merchandising, ordering, or item-counting tasks, is emerging as a key virtue. The intent is to drive more accurate routine decisions, “free” store associates, and empower them with digital tools to feel better about their jobs and provide better service experiences for shoppers."

15. In-store Sensing

James: "I was on the prowl for in-store sensing and messaging innovation. The goal, I believe (although few state it explicitly), is to provide a level of granular data and insight into the physical store that approaches what retailers have become accustomed to in their digital stores. Much of this is enabled by internet-of-things devices, including video cameras aimed at products and people, LiDAR, motion sensors, RFID, electronic price labels, and smart in-store digital displays – not to mention data captured from the POS and shopper loyalty programs. Handhelds used by store associates are plugged into this world too. Conformance with shopper privacy laws adds a major wrinkle, and nobody breathed a word about facial recognition."

16. Connectivity and Data Analysis

James: "All these devices require massive connectivity, and the telecom giants were vigorously talking about how stores need to link all of it together with a mix of 5G, Wi-Fi, and wired networks. The gargantuan task of Interpreting all these data is increasingly being handed over to AI platforms which are being “trained” to recognize the patterns and insights that drive merchandising and operational decisions. “AI built-in” was a frequent claim at booths I visited, but retail tech buyers have their work cut out for them when it comes to separating the top performers from the pack.

While we heard much about AI, there were no retail robots to be seen. It seems that the novelty has worn off."

Nicole Leinbach, Founder, Retail Minded

Nicole Leinbach, Founder, Retail Minded

Nicole: "The innovation lab remained one of my favorite experiences of NRF, where I explored solutions such as Fit: Match and more. Having a front-row seat to the future of retail is a privilege, and this year truly reminded me of that honor and also, responsibility.

Additionally, I loved seeing the partnerships and integrations of retail solutions, such as the dynamic ones we see with Salesforce and various partners, such as OSF Digital and Merkle. I look at NRF as the celebratory kick-off to the year ahead of retail, and this past NRF was no exception."

In Sum

How does anyone make sense of sixteen retail trends? Don’t try to consume them all but know these are what many companies are offering to solve the dilemma of serving the customer and the retail crew where they are, when they need it, and how they want it.

The missing piece often at NRF? Training employees how to sell the merchandise so many spend so much time ordering, moving, and inventorying.

If you’d like help driving more conversions from lookers to buyers, check out SalesRX.com, my online retail sales training program.

![Retail Store Merchandising Ideas to See in New York [Pics]](https://www.retaildoc.com/hs-fs/hubfs/IMG_0872-reddywindows.webp?width=102&height=111&name=IMG_0872-reddywindows.webp)